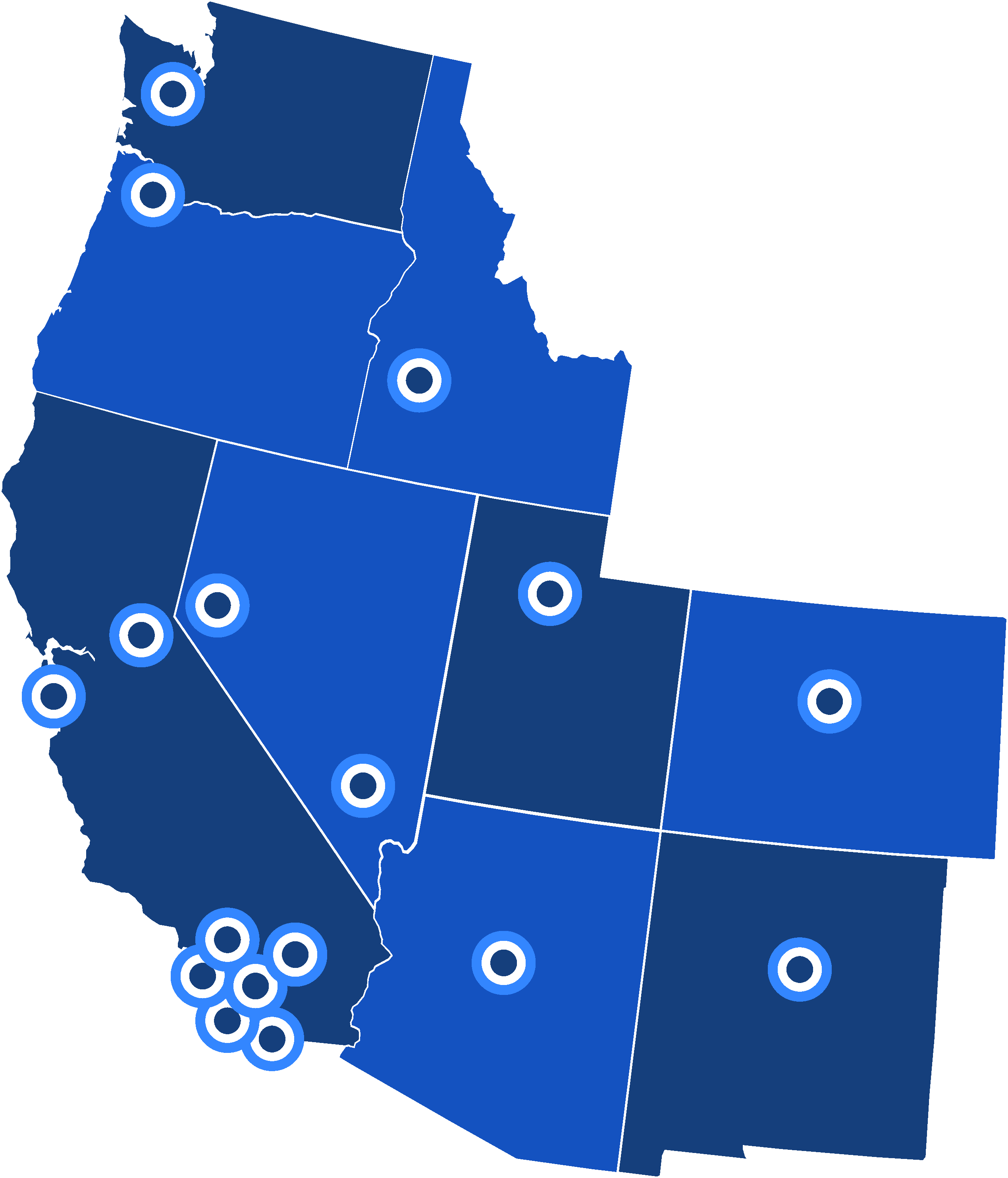

BCE’s formula for success is built around a singular focus on value-add multifamily and workforce housing in high-growth markets throughout the western United States. Priced below institutional investor targets and beyond the means of smaller investment companies, these underperforming assets are primed for a new vision.

Adhering to a modest leverage acquisition strategy, BCE maximizes operating and asset values via capital improvement campaigns, repositionings, and superior property and asset management. Upon optimal market conditions, these reimagined properties are assembled into portfolios that attract the interest of institutional buyers and deliver outsized returns.